Bookkeeping solutions for 2026

“Bookkeeping is the foundation of any successful business…”

Experienced Bookkeepers

Our experienced bookkeepers keep your records accurate and up to date, so you can make financial decisions based on real numbers — not guesswork. We work closely with every client, because the better we understand your business, the more precisely we can process your financial information and deliver meaningful, insightful reports.

We also ensure your systems and software are working together seamlessly, so your data is always reliable.

We’ve been certified Xero partners since 2014, with years of experience helping clients make the most of cloud accounting. The benefits of working in the cloud far outweigh traditional bookkeeping methods — from real-time access to automated processes.

Software providers are constantly improving their products, and we stay ahead of those changes. We’ll guide you in choosing and setting up the right add-on software, and ensure every integration is configured correctly so your data flows seamlessly.

Cloud Accounting & Integrations

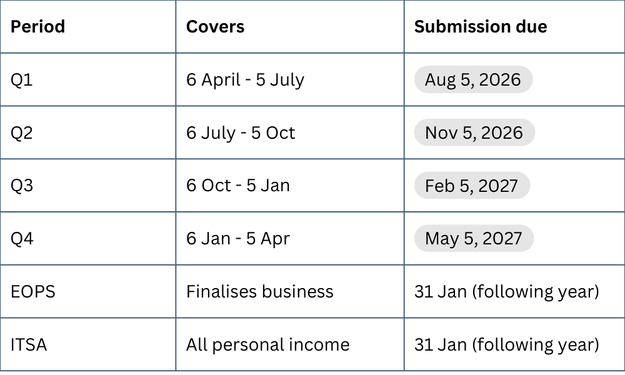

Making Tax Digital for income tax from April 2026

From 6 April 2026, Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA) becomes mandatory for sole traders and landlords whose combined gross income from self-employment and property exceeds £50,000 within a tax year

The requirement phases in further:

April 2027: compliance extends to those earning over £30,000.

April 2028: it applies to those with incomes over £20,000

What This Means

You’ll need to:

Keep digital records using HMRC‑approved software.

Submit quarterly update reports summarising income and expenses.

For example, for Q1 (6 April–5 July), the report is due by 5 August

File a final declaration by 31 January following the end of the tax year — replacing the traditional Self Assessment tax return

We’ll guide you through choosing the right software, setting up digital record‑keeping, and staying fully compliant.

Our MTD Readiness Assessment gives business owners and landlords complete clarity on whether their records, software, and workflows are ready for HMRC’s new quarterly digital submission requirements.

As part of the review, we will:

Check your current bookkeeping system and digital record-keeping capability

Test bank reconciliation status and accuracy of ledger balances

Review receipt and supplier invoice capture processes

Check MTD software compatibility and HMRC API connectivity

Assess tracking for multiple income streams (trading, rental, partnership)

Provide a structured, scored report with actionable next steps

Assign a traffic-light readiness rating for fast, at-a-glance insight